What is WGS Peer to Peer Lending Software?

Who said that lending money can only be done at a bank? As the trend of digital media is coming, people nowadays have found a new way to put their investment thru online lending application platform. They believe that Peer to Peer Lending has more benefit towards investment progress, as it will allow them to earn higher returns than bank deposit and has lower interest rates, compared with lending money from a bank loan.

As more people have been attracted to participate, Peer to Peer Lending Platform has become a modern business model. Then, how about you make a new one with your own rules, that stay in accordance with your country’s regulation?

Whether you are going to build a new business model or turning your conventional lending business to a digital model. Our offer will definitely help your dream come true. We offer a complete service of Peer to Peer Lending that covers three major roles: lenders, borrowers, and admin, that will help you to:

- Introduce the lending regulation and workflow

- Monitor cash-in and cash-out financial flow

- Finalize funding withdraw

- and many more

So, what are you waiting for, let’s start your fintech business!

What would you get by purchasing this product?

Saves Times

All systems are monitored by the online platform, so people looking for loan and investment can be processed faster with a direct agreement between involved parties.

Optimizing Budget

Opening an online platform means you need less money than opening a credit-loan outlet or a pawnshop. By using this application with good socialization effort, you can reach and help a wider market and audience.

Secure with Safety Standard

Our application code is applying modern code safety and standards including:

- electronic form

- web form session time, which created to avoid data manipulation

- scan for virus on every document & picture before being uploaded to the server

- and many more

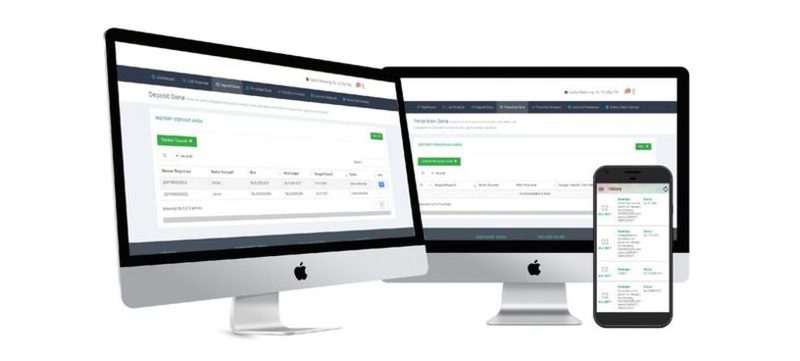

Easy Access

Lenders, borrowers, and admin can access their data and dashboard via two major platforms, web-based and mobile-based, which ease them to access their data anywhere and anytime they want.

Here are the detailed features for your Lenders

01. Dashboard

As they agree to the term & condition, user will receive a lender ID and a bank virtual code number to deposit their money as their first fund. Lender is supported by dashboard feature where they can check:

- Remaining balance

- Total funding

- Funding data, such as: personal data of funding history

- Update profile

- Funding list

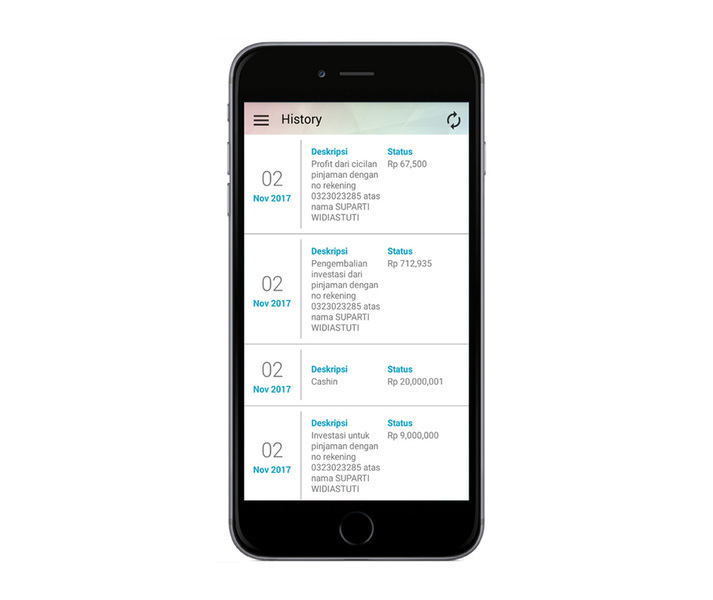

02. Cash-In and Cash-Out

With this feature, the lender can put their money on your cash-in deposit, withdraw their money from the deposit box, and monitor their own cash-out history.

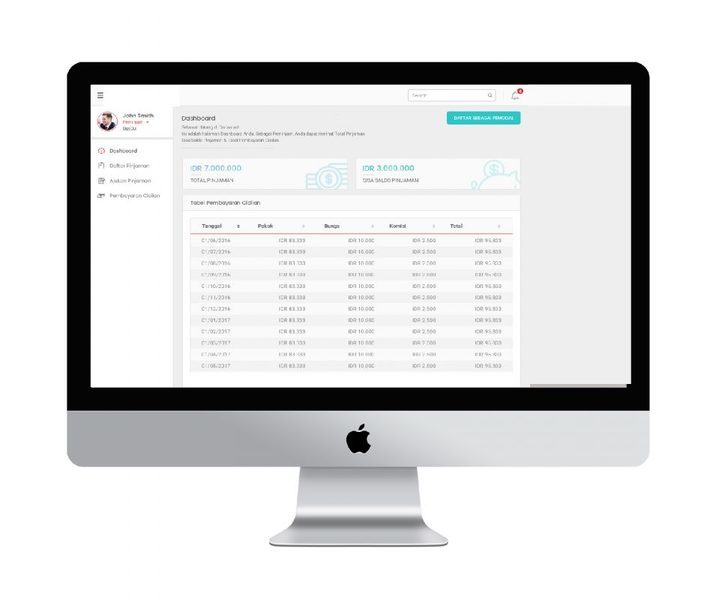

Here are the detailed features for your Borrower

01. Dashboard

Borrower will receive a borrower ID and virtual account for the fundraising effort, with access to monitor their:

- Total funding

- Remaining loan balance

- Borrowing data

- Borrowing list

02. Installment and Borrowing List

This feature helps user to manage their financial and cash flow, including:

- Overlook of their borrowing transaction history

- Show the installment data that have been agreed and funded

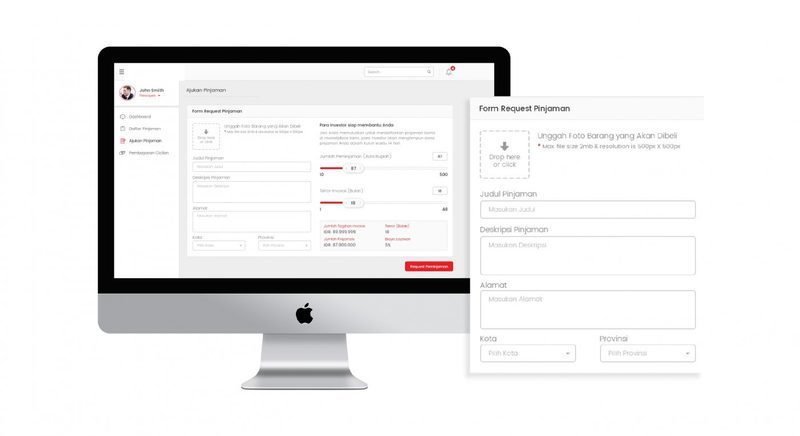

03. Borrowing Application

This feature help borrowers to request a funding from lenders. Just fill in an eForm, then the application will be directly posted in the lending marketplace.

04. Borrower’s About and Contact Us

This space is specially built for borrowers to explain:

- Company history

- Vision and mission

- Staff and company director

So, they can draw more attention from the lenders and get their request funded.

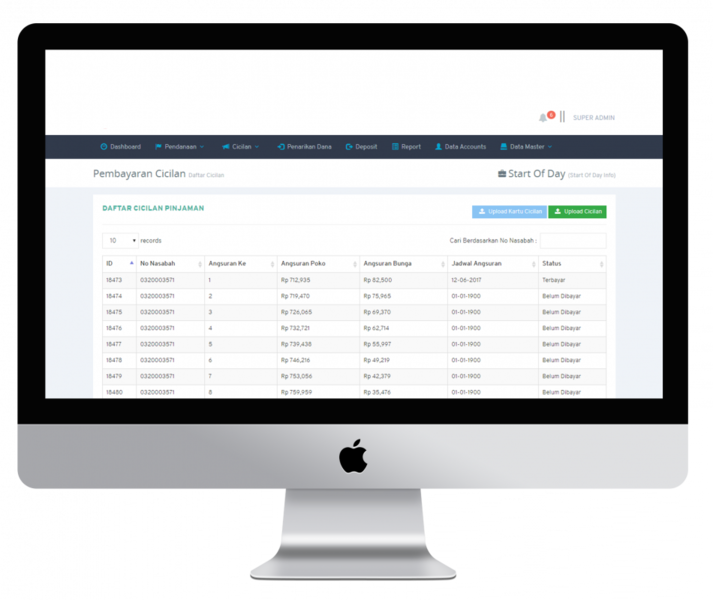

Here are the detailed features for your Admin

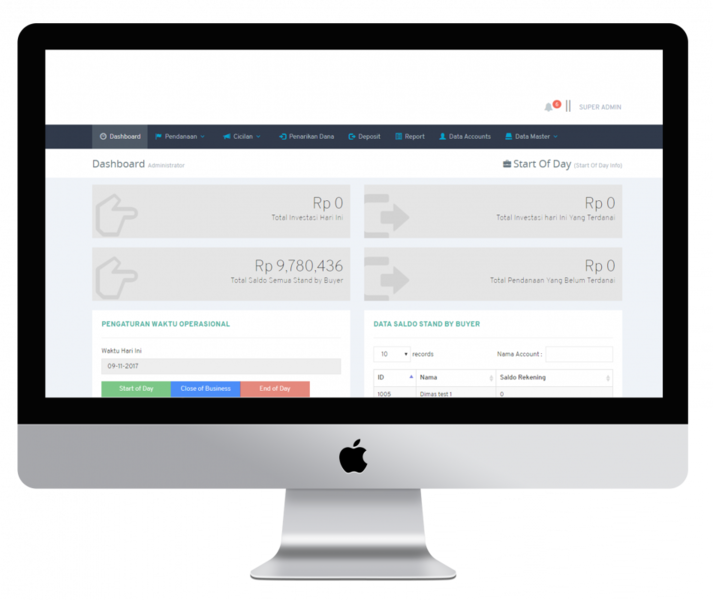

01. Dashboard

Dashboard can be used as a control room of your peer to peer lending platform, where admin can obtain periodical data onto lending rate and show you a chart data based on installment and borrowing rate.

02. Funding

Admin has permission to edit clarification data that has been applied by the borrower based on the survey that your staff did beforehand. Your admin, can also redeem the money from the deposit and transfer the funding money directly to the borrower.

03. Funding Withdraw

Admin has an authority to confirm every cash-out request that has been made by lenders.

04. Deposit

Monitor lender’s deposit data and confirm their incoming balance saving.

05. Payment Distribution

Peer to Peer Lending Software is supported by automatic payment distribution, such as:

- Payment system via Virtual Account

- Borrower’s monthly credit payment will also automatically have distributed for both your finance company and involved lenders.