What is WGS White-label Modern Digital Banking App?

Digital Banking Application is a mobile digital banking application that provides an automation system to process numerous tasks of banking processes from front-end to back-end. Everyone can use this application with such a convenience to do all the necessary banking transactions on smartphones without the need to come to the physical location.

The system provides a convenient automation delivery of products and services such as loan application, wallet top-up, purchasing products at partnering e-commerce, remit balance to a bank account in Indonesia, cryptocurrencies top-up and conversion, pay and receive money, buy discounted vouchers, and many more.

What will you get by purchasing the product?

Account Management Setting

The user can easily check on their balance, view transaction statements, bills payment, money transfers, or setting up profile and notification alerts through email, text, or push notifications from the account management setting.

Securely Bank Account Protection

The system provides secure protection on the user's mobile device with a barcode scanner, lock/unlock button to prevent unauthorized use, face recognition, and passcodes update and security settings anytime.

Budgeting and Tracking

![]()

The user can view clearly their financial transaction history from the dashboard so they can monitor and control their spending and see whether the money goes to the right course.

Convenient Payment and Transfer

With an internet connection, the users can schedule or pay bills, making money transfers between accounts, or exchange money with anyone in another bank account from the application with quick and secure transactions.

Advertising Spot

The application provides a partnership opportunity for vendors who want to increase leads and customer engagement by promoting their products and brand in an advertisement display.

Here are some of the detailed features of the app:

01. Easy money transfer

The application provides money transfer exchange rate service in real-time with the best rate and low fees within seconds by using their own bank account or sends and receive money easily with an integrated wallet in the application.

02. Remittance

The system provides a cross-border overseas payment that allows the users to transfer or send money online to another bank account directly through the application easily.

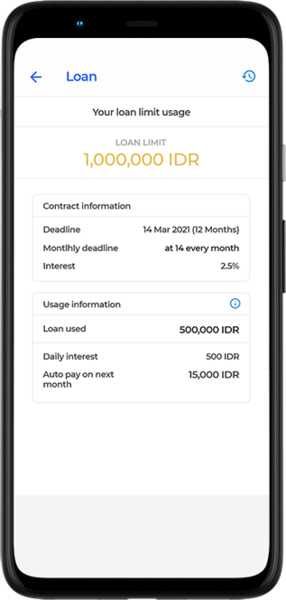

03. Ease on a loan application

The system presents a feature for a loan with the maximum permitted level complemented with certain interest rates, amortization periods, and loan balances so the users do not need to go to the bank physically anymore.

04. Virtual Account

The users can use a virtual account suitable to their business needs to identify payments that are linked to the master account so the users can save time and cost for better payment processes management.